The 2025 USA Reshoring Survey of 500 U.S. manufacturers, a collaboration between the Reshoring Initiative and Regions Recruiting, reached an actionable conclusion. A sufficient quantity and quality of U.S. workforce would bring back more manufacturing than any of the other surveyed options — tariffs, a lower U.S. dollar, lower tax rates or fewer regulations.

The survey was designed to glean 3 key insights: first, to understand the decision-making process or the “why” behind Original Equipment Manufacturers (OEMs) reshoring; second, to understand the perspective of contract manufacturers (CMs) in the OEM supply chain; and third, to acquire a deeper understanding of the actions needed to increase the rate of reshoring. The survey revealed the priorities for America’s reindustrialization as: level the cost playing field, a larger skilled workforce, use TCO and prepare for geopolitical risk. Let’s dig deeper.

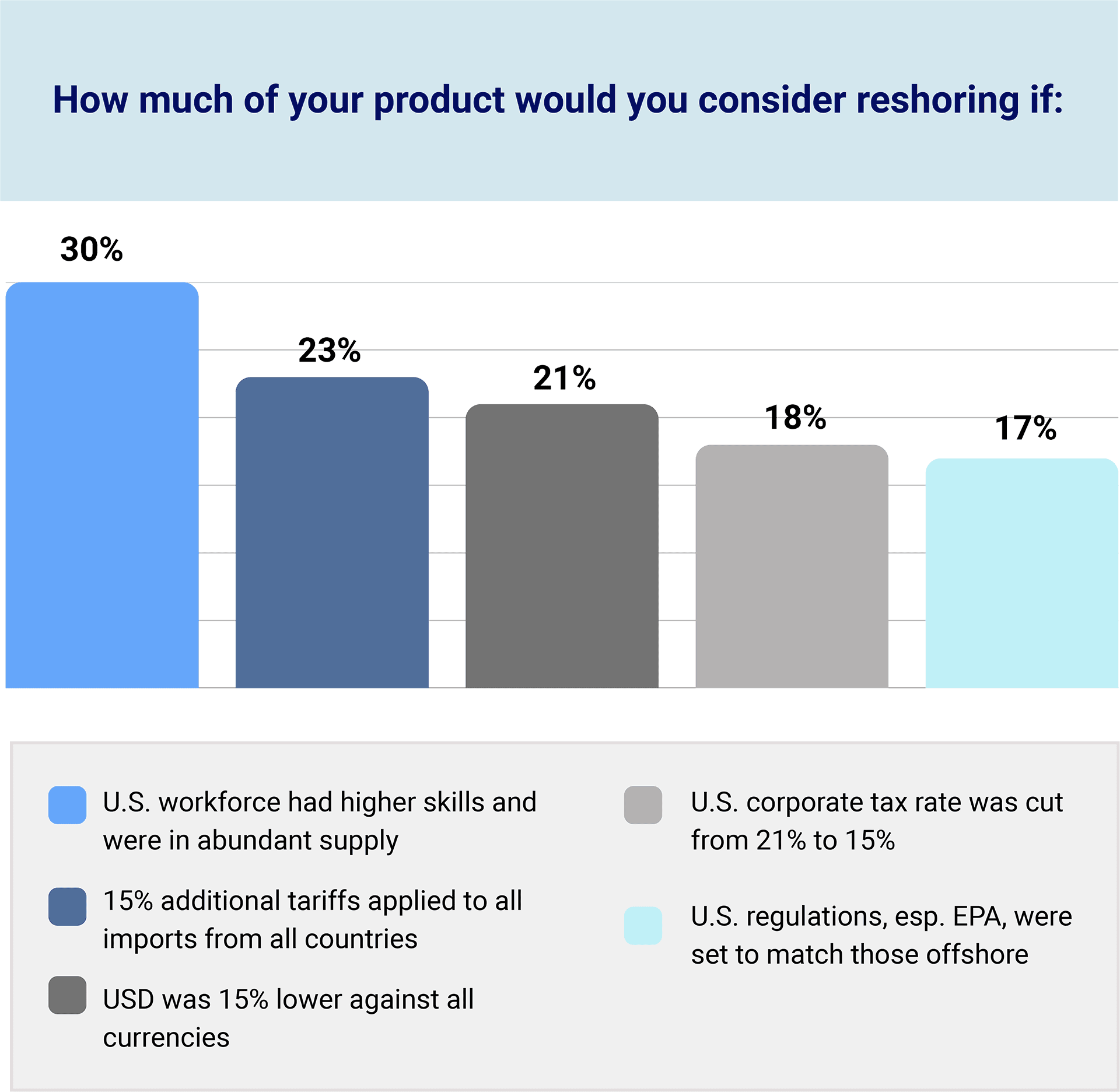

OEM Figure 1: The top trigger for increased reshoring was having an abundant, highly skilled workforce available in the U.S. Given that resource, OEMs would reshore 30% of their products currently offshored. (2025 Reshoring Survey)

The Primary Driver for Increased Reshoring

The top trigger for increased reshoring was having a larger, stronger skilled workforce available in the U.S. Given that resource, OEMs would reshore 30% of their products currently offshored. If 15% tariffs were applied to all imports from all countries, OEMs said they would bring back 23% of what they currently offshore. This was followed by a 15% reduction of the USD (21%), corporate tax rate cuts from 21% to 15% (18%) and U.S. regulations set to match those offshore (17%). Companies understand they need more workforce quantity to increase output and better training to improve competitiveness.

The success or failure of training millions of workers could skew the outcome of the U.S. reindustrialization momentum in either direction. Even without a surge in reshoring, 2.1 million manufacturing jobs are forecast to go unfilled by 2030, with an estimated loss to GDP of $1 trillion. Continued success of reshoring would increase that shortfall to 3 million or more.

Successful reshoring also requires an established ecosystem of suppliers and intermediaries encompassing all steps, from raw materials to finished product.

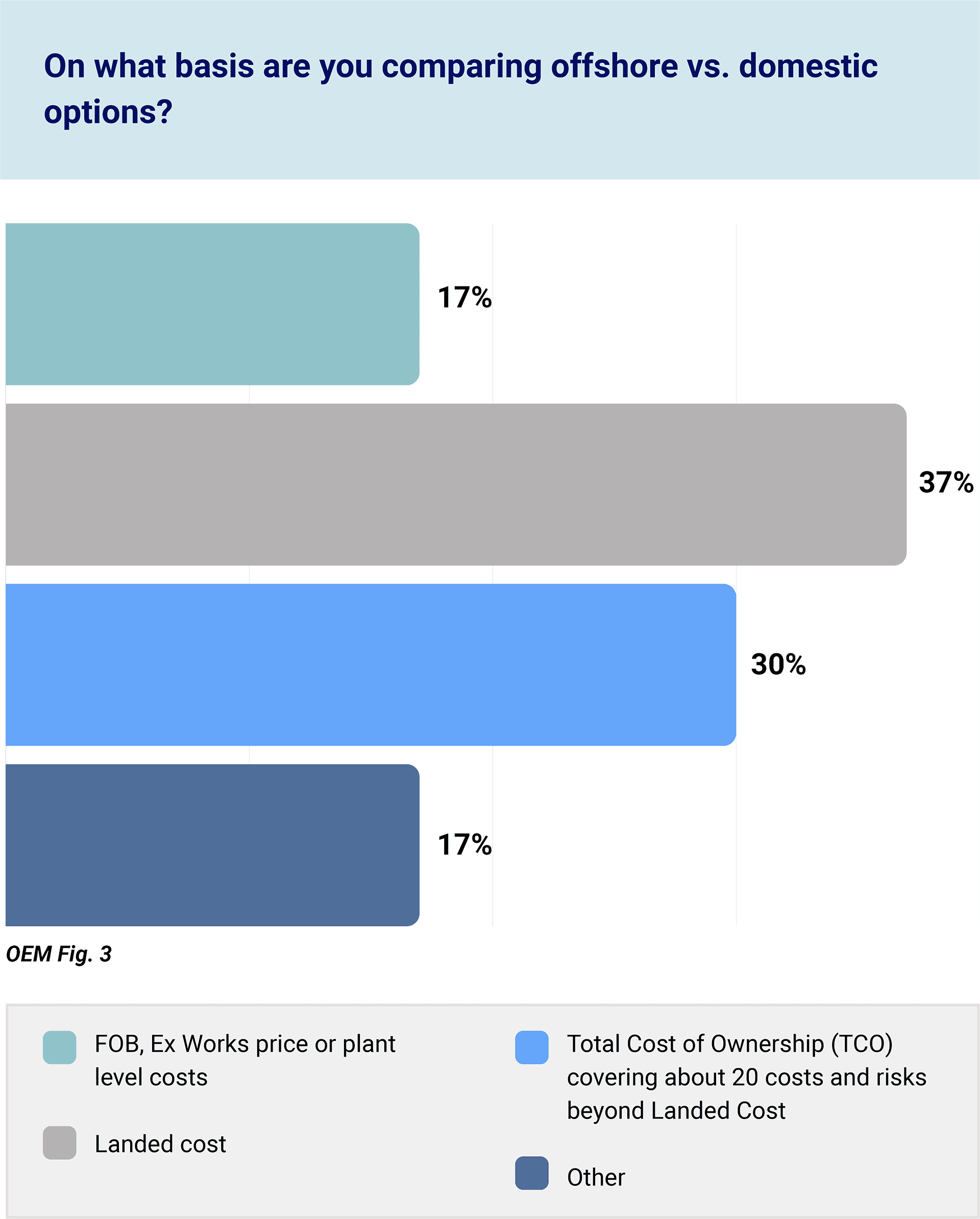

OEM Figure 2: Only 30% of OEMs use total cost of ownership (TCO) in comparing domestic to offshore

sourcing. 17% continue to use Ex-Works or plant level costing, and 37% use Landed Cost.

17% use some other form of costing for their suppliers. (2025 Reshoring Survey)

Shifting OEMs to TCO Would Reshore Billions of Dollars

Only 30% of OEMs use total cost of ownership (TCO) in comparing domestic to offshore sourcing. Seventeen percent continue to use Ex-Works or plant-level costing, and 37% use Landed Cost. Seventeen percent use some other form of costing for their suppliers (Figure 2).

Often, these methods result in a 20 to 30% miscalculation of actual offshoring costs. The Reshoring Initiative’s Total Cost of Ownership (TCO) Estimator® is a free online tool that helps companies account for all relevant factors—overhead, balance sheet, risks, corporate strategy and other external and internal business considerations—to determine the true total cost of ownership.

Shifting the lion’s share of OEMs to a full-bodied TCO system would reshore $200 billion of manufacturing with no government subsidies, no supply chain shock, no retaliation and no impact on inflation after companies factored in all global risks and costs. By using TCO, instead of less complete measures of cost and risk, OEMs can both increase profitability and benefit all stakeholders. Data on 190 cases comparing China to the U.S. showed the U.S. win rate going from 8% based on price to 32% based on TCO.

Contract manufacturers (CMs) can use TCO to make a case with customers when competing with offshore competitors. For example, Morey Corp., an Illinois-based electronics CM, reported that TCO was the key to winning a $60 million order when competing against a lower-cost Chinese competitor.

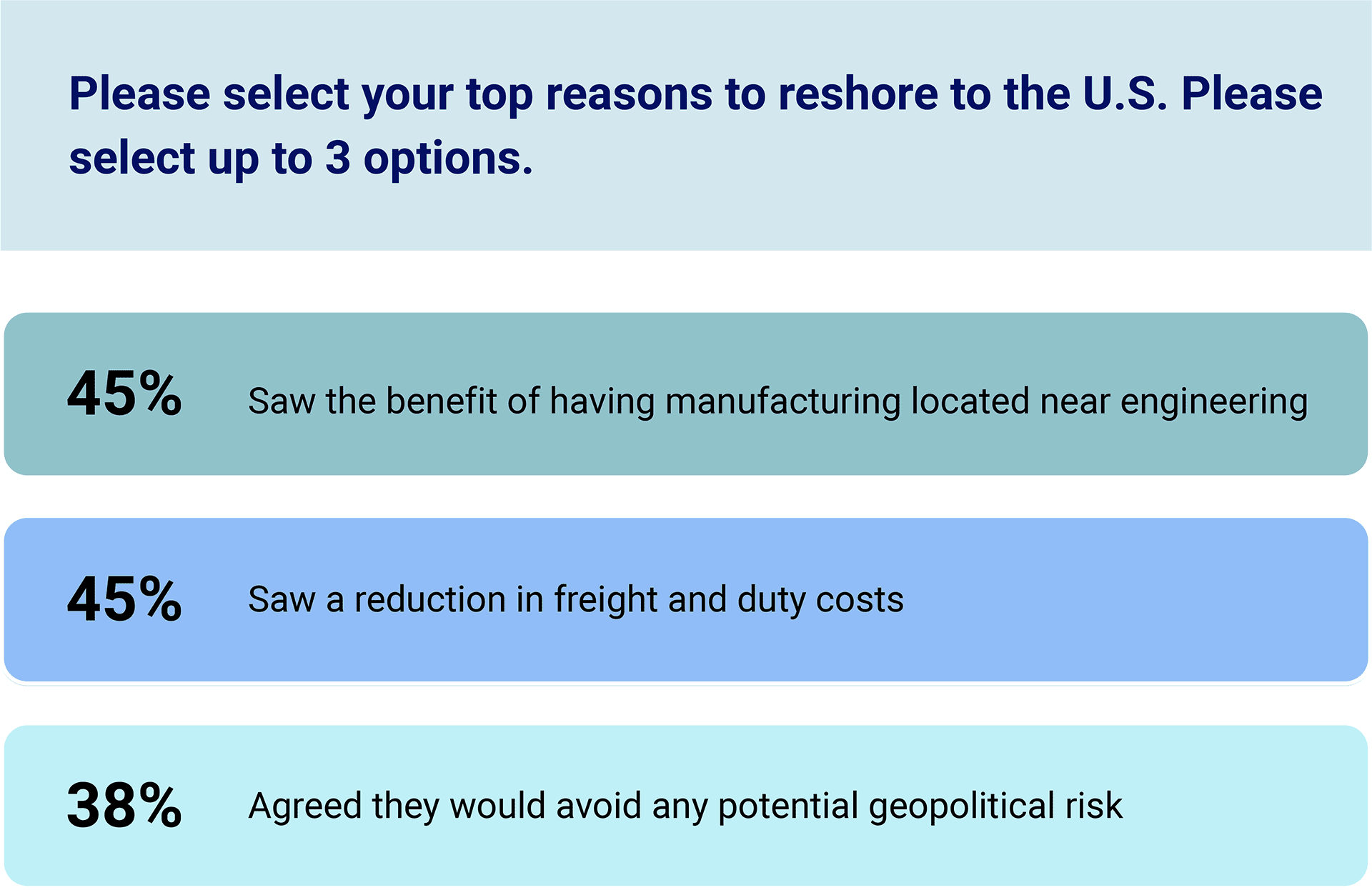

OEM Figure 3: The top three reasons OEMs gave for reshoring to the U.S. (2025 Reshoring Survey)

An Inflection Point—Prepare for Geopolitical Risk

The U.S. manufacturing sector is at a critical juncture. The 2020 global pandemic and its associated aftershocks exposed vulnerabilities in the U.S. supply chain due to our $1.2 trillion goods trade deficit.

U.S. manufacturers are reevaluating sourcing strategies beyond low-cost countries and planning for supply chain risks that could cause long-term disruptions worse than those experienced during the pandemic. The survey results reveal that many manufacturers are considering the collaborative benefits of locating manufacturing near engineering (Figure 3), and are placing a high value on the quick delivery achieved by localization strategies (Figure 4).

Proximity of Engineering to Manufacturing

The top three reasons given to reshore were locating manufacturing near engineering (45%), the benefit of reduced freight and duty costs (45%), and avoiding geopolitical risk (38%). The OEMs place considerably more emphasis on engineering’s proximity to manufacturing (45%) versus CMs (22%). This differential suggests CMs have an opportunity to demonstrate their capabilities as trusted technical solutions partners to the OEMs.

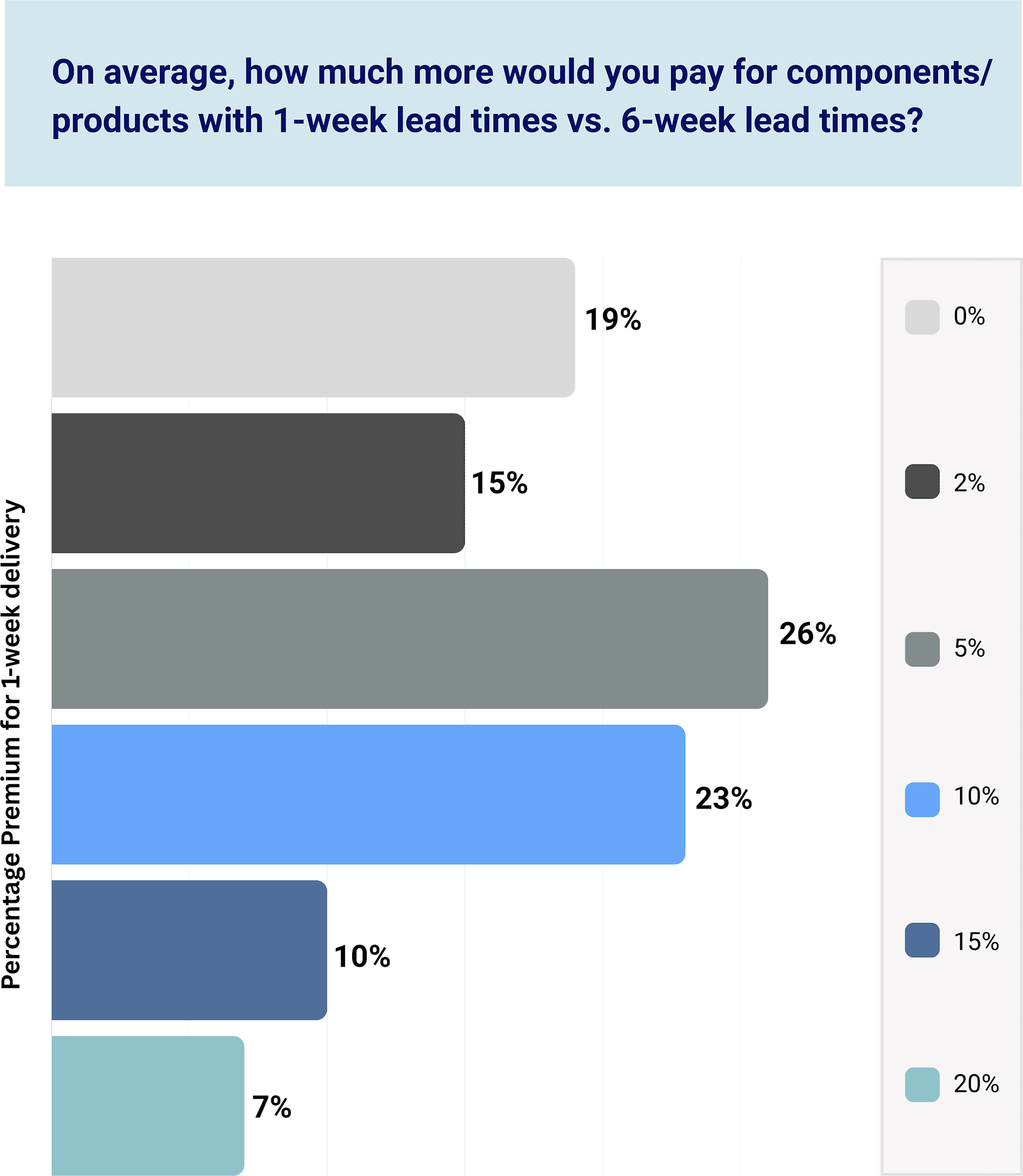

OEM Figure 4: 43% of OEMs value fast delivery and would be willing to pay 10% to 20% more for components if they could be delivered within a 1-week lead time versus a 6-week lead time. (2025 Reshoring Survey)

Percentage Premium for a One-Week Delivery

Forty percent of OEMs were willing to pay 10% to 20% more for five weeks faster delivery. This premium for shorter lead times points to a great opportunity for CMs. Typical delivery time by surface freight from inland China/Asia to the Midwest is about 6 weeks. Presumably, the benefit comes from much smaller inventories and better availability.

Other Interesting Results

Details on these results are available in the full report:

- 95% of OEMs were fully or somewhat satisfied with the results of their reshoring.

- The biggest sources of reshoring were first, China; second, Southeast Asia.

- 31% of OEMs said their businesses would be severely or moderately negatively impacted if all illegal immigrants were deported.

- 32% of OEMs were still planning to offshore, primarily driven by cost and availability of products or components.

Considerations for OEMs

OEMs’ reshoring benefits will significantly come from risk reduction, enhanced customer satisfaction and improved balance sheets. Another benefit will come from volume increases by taking domestic market share from foreign competitors that do not sufficiently invest (foreign direct investment) here.

Localizing production and sourcing will not only reduce geopolitical risk, but it will make supply chains more resilient and sustainable, encourage investment in infrastructure and workforce development, strengthen the U.S. economy and generate well-paying jobs in manufacturing and other industries through the multiplier effect.

Many multinationals headquartered in the U.S. and allied countries produce in China to supply the U.S. market. Shipments to the U.S. from these factories could take multiple hits: China export bans, U.S. tariffs and Taiwan-related geopolitical risk. Seventy-seven percent of OEMS are concerned about the risk of a Chinese invasion of Taiwan, yet 51% have not identified products to reshore now as insurance. The best way to avoid these risks is to supply the U.S. by reshoring or nearshoring.

Recommendations for Federal Policymakers

The best way to increase the rate of reshoring and protect the U.S. from increasing geopolitical risk is to implement an effective national industrial policy. Such a policy should focus on broadly leveling the cost playing field, providing the needed quantity and quality of workforce, dramatically reducing regulations and allowing for immediate expensing of capital investments such as automation.

A lower U.S. dollar, reversing some or all of the dollar’s overvaluation, is preferred to tariffs, since it reduces imports and increases exports. Tariffs reduce exports because of retaliation, as we have seen implemented or threatened in the spring of 2025.

Automation makes U.S. manufacturing more cost-competitive, enabling more reshoring that requires still more automation, creating a virtuous cycle. Unfortunately, immediate expensing is part of the 2017 Tax Cuts and Jobs Act and is being phased out, slowing automation efforts.

Three Federal Actions to Strengthen the Skilled Workforce

Here are our suggestions for a few policies and federal actions that would provide a larger and stronger skilled workforce.

First, recognize that the current state of the U.S. workforce is bottlenecking reshoring efforts. Change dozens of websites of the Departments of Labor and Education from promoting “university for all” to “a good career for all.” Show that apprenticeship graduates have incomes similar to bachelor’s-degree holders.

Second, reduce federal loans for students seeking degrees in over-supplied fields, and shift resources to apprenticeship and trade-school loans.

Third, create a Small Business Administration (SBA) investment loan guarantee conditional on workforce development.

More suggestions are available in the Reshoring Initiative’s Competitiveness Toolkit.

The strategies the country implements now will shape the future of American manufacturing for decades to come.

Are You Thinking About Reshoring?

We encourage companies to implement the top priorities for reindustrialization revealed by the survey—build a strong talent pipeline, use total cost of ownership and prepare for geopolitical risk.

For help, contact me at 847-867-1144 or email me at harry.moser@reshorenow.org.

This article was originally published by IndustryWeek and was republished with permission from The Reshoring Initiative.

Post Category

- Sin categoría

Topic

- Reshoring

- Workforce Development

Published Date

agosto 14, 2025

Byline